Deloitte’s Guide to Smart Investing in 2024

Navigating the Uncertainties of 2024: A Macroeconomic Overview

Deloitte’s 2024 Smart Investing guide begins by acknowledging the significant uncertainties facing investors. Geopolitical instability, persistent inflation, and the potential for further interest rate hikes all contribute to a complex and challenging investment landscape. The report emphasizes the need for a diversified and adaptable strategy, capable of weathering unexpected market shifts. Understanding the interplay of global events and their impact on various asset classes is paramount for successful investing this year.

Inflation’s Persistent Grip and Its Impact on Investments

Inflation remains a major concern. Deloitte’s analysis suggests that while inflation may begin

Secure Your Future with Axim Wealth Management

Understanding Your Financial Goals

Before embarking on any investment journey, it’s crucial to define your financial aspirations. What are you saving for? Retirement? Your children’s education? A down payment on a house? Perhaps it’s a comfortable early retirement or leaving a legacy for your family. Axim Wealth Management works with you to clarify these goals, turning abstract desires into concrete, measurable objectives. We delve deep into your current financial situation, understanding your income, expenses, and existing assets to create a personalized roadmap tailored to your unique circumstances.

A Personalized Investment Strategy

Generic investment strategies rarely yield optimal results. At axim

Curzon Wealth Your Financial Future, Secured.

Understanding Your Financial Goals

Before diving into investment strategies, Curzon Wealth takes the time to truly understand your aspirations. We believe that financial planning isn’t just about numbers; it’s about your life goals. Whether it’s securing your children’s education, planning for a comfortable retirement, or funding a dream vacation, we work with you to define these objectives clearly. This personalized approach ensures that every financial decision aligns with your unique vision for the future. We’ll discuss your current financial situation, including income, assets, and debts, and create a comprehensive picture that forms the bedrock of our planning process. This open

Smart Investing Your Guide to Market Trends

Understanding Market Cycles

The stock market, like the tides, ebbs and flows. It’s not a straight line to riches; instead, it’s characterized by cyclical patterns of growth and decline. Understanding these cycles—bull markets (periods of rising prices) and bear markets (periods of falling prices)—is crucial. Recognizing where we are in the cycle can help you make informed decisions, whether that’s buying low during a bear market or taking profits during a bull market. Studying historical market data can provide valuable insights into the typical duration and characteristics of these cycles, though it’s important to remember that past performance is not

Understanding Passive Activity Loss Rules Key Insights

Navigating the World of Passive Activity Loss Rules

Understanding passive activity loss rules is crucial for anyone involved in real estate investments or other passive income-generating activities. These rules can have a significant impact on your tax liability and financial planning strategies. In this article, we’ll explore key insights into passive activity loss rules and how they affect taxpayers.

Defining Passive Activity Loss

Passive activity loss refers to losses incurred from passive activities, such as rental properties, limited partnerships, or other investments where the taxpayer is not materially involved in the day-to-day operations. These losses can offset passive income but

Gig Economy Employment Law: Navigating Work Dynamics

Gig Economy Employment Law: Navigating Work Dynamics

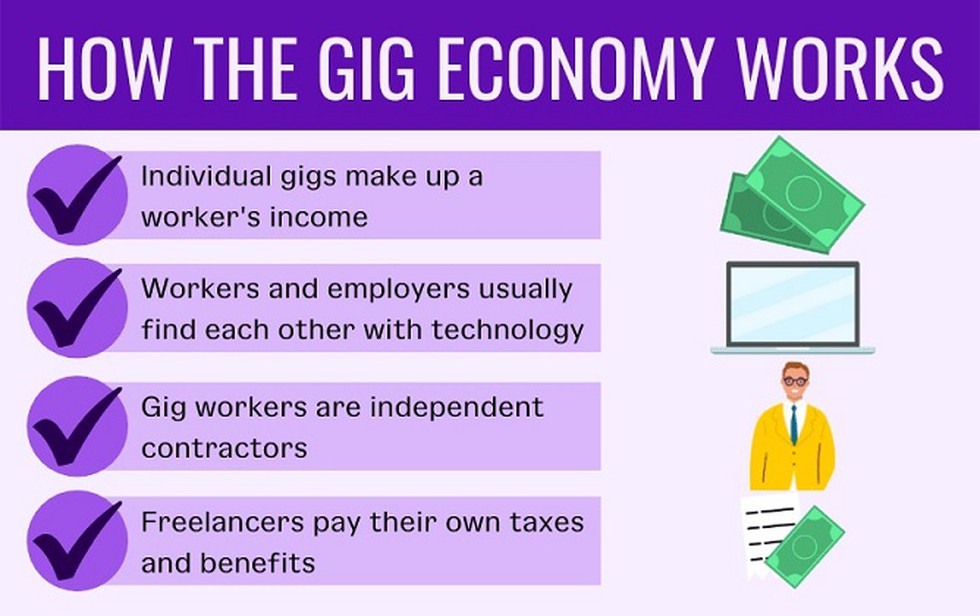

The gig economy, characterized by short-term and freelance work, has transformed the traditional employment landscape. As this trend continues to rise, it brings forth a host of legal considerations and challenges. In this article, we delve into the intricacies of employment law in the gig economy, exploring the rights, responsibilities, and evolving dynamics for both workers and employers.

The Rise of the Gig Economy

The gig economy, fueled by platforms connecting freelancers with businesses and individuals seeking services, has seen exponential growth. While offering flexibility and diverse opportunities, the gig economy has raised