Data Localization Laws: Navigating Global Data Sovereignty

Data Localization Laws: Navigating Global Data Sovereignty

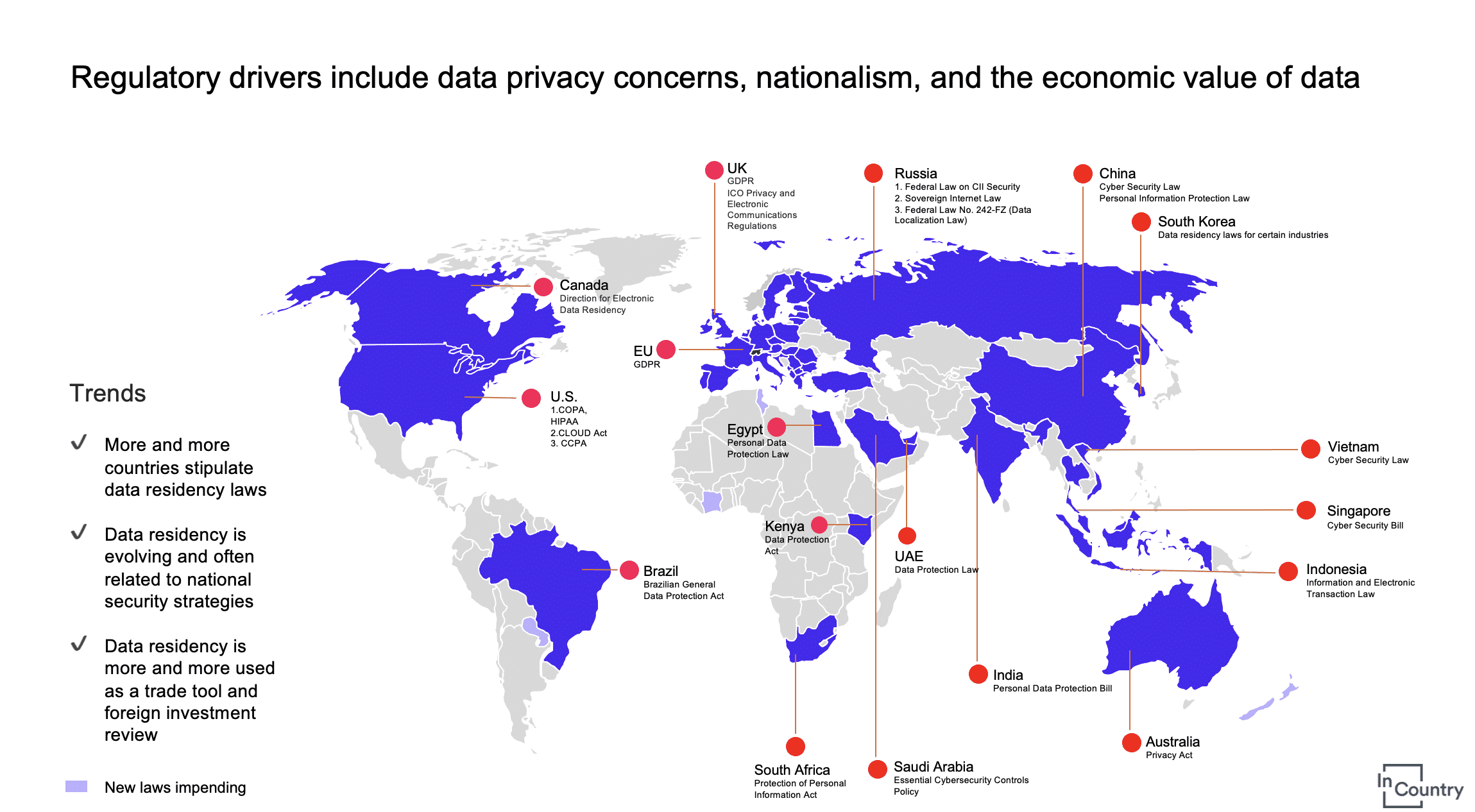

In an era of digital globalization, the concept of data localization has gained prominence as governments worldwide seek to assert control over the storage and processing of their citizens’ data. This article explores the landscape of data localization laws, examining the motivations behind them and the implications for businesses operating in a globally interconnected digital environment.

Understanding Data Localization:

Data localization refers to the legal requirement that certain types of data be stored and processed within the borders of a specific country. The intention is to ensure that sensitive data, often related to

Cryptocurrency Taxation: Navigating Financial Obligations

Cryptocurrency Taxation: Navigating Financial Obligations

Cryptocurrency, once a niche interest, has become a significant aspect of the financial landscape. As its popularity rises, so do regulatory efforts surrounding cryptocurrency taxation. Understanding the tax implications of crypto transactions is crucial for individuals and businesses alike.

Taxation Basics for Cryptocurrency

The first step in navigating cryptocurrency taxation is grasping the basics. In many jurisdictions, cryptocurrencies are considered taxable assets. This includes transactions such as buying, selling, trading, and mining. Cryptocurrency holdings are subject to capital gains tax, and each transaction may trigger a tax event.

Capital Gains Tax and Reporting Obligations

Capital